It's not surprising that QE3 has emerged as a partisan topic. Although the positions against more monetary stimulus are varied, we'll address the comments that previous episodes of Quantitative Easing "did not work." The common complaint is that lending did not increase enough to justify the effort. This is partly true, but mostly misguided.

There's a lot of different places to look if you want to assess the effectiveness of QE, and lending is just one of them. You can look at the change in yields on different assets (like they did at Northwestern), and see a substantial effect.

QE1 bought treasuries and mortgage-backed securities, both saw serious drops in yields. In more layman's terms, the interest paid by the government and mortgage borrowers went down; you can see this in the decline in yields for Mortgage-Back Securities (MBS). No doubt. High-grade corporate debt also went down (since it is a somewhat similar market to treasuries), making it easier for them to borrow too.

QE2 was less effective, because it was more focused. They didn't buy MBS the second time around. Regardless, both of the previous QEs raised inflation expectations, which you could see by tracking TIPS (the inflation-protected version of US government debt). The same inflationary pressure was seen in Britain during the Bank of England's QE operations.

Because of QE efforts, the US government could actually borrow at negative (real) interest rates. In other words, the rate of interest was less than the expected rate of inflation. QE made things much easier for the government to spend some money, if it wasn't so gridlocked.

If you want to get more of the details on the current version of QE, you should check out Scott Sumner's FAQ, which describes nominal GDP targeting, a type of monetary policy that is very similar to what the Fed is currently doing. It's kind of odd, because NGDP targeting is very friendly to libertarians (and Scott is included), even though the Ron Paul variety are probably the last people to embrace this type of monetary activism. The idea is that the government should be ignored, and as least intrusive as possible. The Central Bank can create money-driven economic growth as much as it wants. I know it's a different strain of libertarianism (more Milton Friedman than Von Mises), but it's libertarian nonetheless.

So what makes this round of QE special? Well, it seems like they've been learning their lessons. They're buying the most effective asset classes for the kind of monetary stimulus they're looking for (in particular MBS). But more importantly, they're looking to change the expectations for inflation. While a target hasn't been set yet, Bernanke mentioned that they would be more accommodating of inflation if unemployment remains high. This is why the whole "open-ended" side of this round matters. They will continue to pump money, even after things start to get better. If you're sitting on cash, you're going to start losing money.

(And a quick aside on that theme. The Fed should also stop paying interest on reserves. They're currently considering it. It's just that the Fed moves at about the same speed as a glacier. It took three months of debate to get QE3, so be patient.)

I know I've said this before, but it's worth repeating. If you want unemployment to drop, you need to look to increase the inflation rate. Inflation hurts savers (and the rich in particular), in that it reduces the value of hard assets (like bonds), but it helps workers (and the poor, in particular). It makes debt easier to bear, and it encourages spending directly by creating incentives against holding cash. Both are good for attacking the unemployment.

But there's only so much growth you can get through inflation. Too much inflation (let's say 10 percent a year and higher) will cause all sorts of negative side effects. People will stop saving their money, for example. This is why the Fed has a dual mandate (employment and price stability). You have to strike a balance between the two.

It's also the angle that you'll see attacks on the Fed come from. The rich, and their financial representatives, will bitch and moan about the diminishing values of bond portfolios. They'll moan about the damage to "pensioners," conveniently forgetting that only a small portion of Americans own lots of bonds. Just ignore them. Their stake in all of this is obvious. They don't want a recovery; they just want to sit on their wealth. The Fed is making sure that they can't.

Sunday, September 30, 2012

Thursday, September 27, 2012

Politics Influence Economic Outcomes More than We'd Like to Admit

Why Nations Fail: The Origins of Power, Prosperity and Poverty

Daron Acemoglu and James Robinson

New York: Crown Publishers, 2012

Institutions, Institutional Change and Economic Performance

Douglass C. North

London: Cambridge University Press, 1990

Several theories of economic development have received attention in the popular press in recent years, even though many of these are based on non-economic foundations. For example, in Guns, Germs and Steel (1997) and Collapse (2005) Diamond presents a largely economic history of the world as determined by geographic and ecological factors. According to Diamond, Western Europe’s dominant role in global affairs, from the 17th century on, can largely be attributed to East-West trade routes, the domestication of certain species, resistances to certain diseases and balkanization. Diamond believes that the latter encouraged greater competition and, eventually, served as the catalyst of European Imperialism.

Another theory was advocated by Landes in The Wealth and Poverty of Nations (1998). Close followers of American politics are probably most familiar with (an incredibly simplified version of) this theory thanks to comments from Republican Presidential candidate Mitt Romney. He tried to explain the differences in wealth between Israel and the occupied Palestinian territories as the result of Israel’s “superior culture.” The ideas that largely cultural factors – like punctuality, industriousness and the willingness to embrace entrepreneurial risk – determine national success is quite old. Weber, for example, wrote about them in The Protestant Work Ethic and the Spirit of Capitalism (2009).

These two theories, along with several others, are decisively dispelled in Acemoglu and Robinson’s new book, Why Nations Fail (2012). By analyzing a series of natural experiments, the authors show the extreme limitations of theories about geography and culture. One of their most famous cases involves the city of Nogales, which lies on the US/Mexico border, between the states of Arizona (US) and Sonora (Mexico). The two sides of the border share similar heritage, culture, geography and climate. Many people living on one side frequently visit friends and relatives on the other. The only substantial difference between the two sides is national affiliation.

Sunday, September 23, 2012

A Chronicle of a Political Death Foretold

A small consensus is forming around the idea that Romney's campaign is now officially "dead." After several weeks of very bad messaging - including a conversation with a chair, bad judgement in his statements on the Middle East crisis, reports of infighting and an already notorious secret video - criticism from moderate stalwarts like David Brooks has been fierce. Unfortunately, these proclamations of imminent campaign collapse are widely exaggerated.

This is a close campaign. It was always going to be a close campaign. As Matthew Dickinson writes,

John Sides shows this effect in his discussion of George Allen's "Macaca moment." While there was an immediate negative effect, similar to the polling shift observed by Nate Silver, it becomes very difficult to see how this influenced the final election results. A few weeks after the statement, once the election finally came around, the race was tied. And even if Macaca did a lot to damage Allen as a candidate, it does nothing to explain how Webb's campaign grew in stature and how that candidate finished so strongly.

So maybe the media makes a little too much out of gaffes (gasp!), and maybe we're blowing the current situation out of proportion. Nonetheless, I think there's another issue, relating to general impression, which I think that this outweighs any short-term reference. While it would be much harder to track, there's clearly a point in a campaign where a candidate just isn't taken as seriously anymore. It could be Al Gore's statements on the Internet, John Kerry "for it before I was against it." These sort of lasting impressions, which persist with us even to this day. They form the kinds of halos that permanently color our impression of these politicians. Jon Stewart continues to show zero respect for John Kerry.

The challenge about this sort of thing, though, is that we don't have any sort of testable hypothesis to work on. The only real evidence about the existence of damning impressions is counterfactual. As Sides explains,

This is a close campaign. It was always going to be a close campaign. As Matthew Dickinson writes,

As I’ve discussed previously, these remarks tend not to have much impact largely because they are filtered through voters’ preexisting ideological beliefs. For this reason, I doubt Mitt’s 47% comment is the game changer that partisan pundits predict/hope it will be. Remember, campaigns tend not to change votes so much as they activate latent predispositions among voters. Yes, it’s possible this time will be different, and that Mitt’s remarks really are a turning point. But in the absence of evidence indicating why this time should be different, forgive me if I don’t take the partisan pundits’ words for it.Dickinson refers to the following chart from John Sides, discussing the strong evidence that gaffes don't really influence polling data.

Now some liberals, including most of the people that would read this post, would look at some of the "gaffes" highlighted above and scoff. But that's the point. While you, liberal reader, don't think that UDBT is a big deal, people on the right say otherwise. This is clearly framing, based on ideological preferences. It's also why we see, over and over again, that "gaffes" don't seem to have too much of an immediate, short-term effect. One side goes up in arms over them; the other shrugs; those in the middle, who hate "politics," mostly ignore it all.

John Sides shows this effect in his discussion of George Allen's "Macaca moment." While there was an immediate negative effect, similar to the polling shift observed by Nate Silver, it becomes very difficult to see how this influenced the final election results. A few weeks after the statement, once the election finally came around, the race was tied. And even if Macaca did a lot to damage Allen as a candidate, it does nothing to explain how Webb's campaign grew in stature and how that candidate finished so strongly.

So maybe the media makes a little too much out of gaffes (gasp!), and maybe we're blowing the current situation out of proportion. Nonetheless, I think there's another issue, relating to general impression, which I think that this outweighs any short-term reference. While it would be much harder to track, there's clearly a point in a campaign where a candidate just isn't taken as seriously anymore. It could be Al Gore's statements on the Internet, John Kerry "for it before I was against it." These sort of lasting impressions, which persist with us even to this day. They form the kinds of halos that permanently color our impression of these politicians. Jon Stewart continues to show zero respect for John Kerry.

The challenge about this sort of thing, though, is that we don't have any sort of testable hypothesis to work on. The only real evidence about the existence of damning impressions is counterfactual. As Sides explains,

The best argument you can make about these gaffes is sort of a woolly counterfactual: “Well, if it hadn’t been for the release of Romney’s video today, Romney would have been able to accomplish X, Y, and Z, which would have helped him win the election.” Like any counterfactual, there is some plausibility—yes, Romney would rather talk about the unemployment rate than these comments.

But like any counterfactual, it’s predicated on assumptions about what the world would have looked like without these comments. And given the tenuousness of any such assumptions, and the (at best) small effects that single events in any presidential general election campaign tend to have, I would stop well short of calling this video “devastating.”So pay attention to public impression, more so than the actual statements. There is some signs that this isn't really going well for Romney, and his campaign is losing most of its credibility. Take this video from Key and Peele for example. But it is still too early to say. It's going to be a very close election.

Sunday, September 16, 2012

Public Choice and the Public Good

Paul Starr over at The New Republic is reviewing Unheavenly Chorus, Oligarchy and the MoveOn Effect. All three are relevant to this blog, especially the first book, which convincingly shows how a relatively small minority of wealthy people can still have the political clout to trump the interests of the majority. As Starr writes:

He's not alone. The central thesis of Hacker and Pierson's Winner-Take-All Politics is that government is an area for organized combat between competing interest groups. Any basic theory of public choice would show that once one specific group becomes disproportionately represented, it only follows that government has the incentives to award them disproportionately. And this is exactly what happened in the last thirty years in America. The only thing guaranteeing the current political framework is the relative strength of competing organized groups.

But what about voters? Starr doesn't pain a pretty picture about the effectiveness of the American populous, and neither do Hacker and Pierson. There is a twofold problem with American representative democracy. The first is that the most demanding aspect of civic engagement, voting, isn't actually the main show. The real competition is over the creation of policy, which is a long, slow process that very few "regular citizens" ever get involved in. It's probably why we make such a big deal about people like Lilly Ledbetter; they just don't come around all that often.

The other, probably more insidious, problem is the persistent lack of awareness and motivation among voters. Few analysts of American politics can find even a single period of American history where the majority of potential voters were well informed and active. This deep pessimism led economists like James Buchanan to conclude, all the way back in the 1960s, to conclude that governments are largely a source of market failure instead of solutions. Many economists would point out that the incentives for people to vote are very small, and it's a surprise that people vote as much as they do.

Because the institutional pressures are so intense, we shouldn't be surprised that voters fail up to the basic standards of American democracy. Nonetheless, the plain ignorance of American voters is very disappointing. As Hacker and Pierson write,

While this is a pretty depressing assessment of American democracy, it is not very new. In fact, this was a problem faced by the Founding Fathers as well. Although Thomas Jefferson's statements about "a natural aristocracy" might sound a little odd to modern readers, the underlying concept is exactly the same as the problem facing American democracy today. As Jefferson writes in a 1813 letter to John Adams,

To understand this potential, you need only to look at the number of representative groups in Washington that only act on behalf of organizations, something like 88 percent of them. Clearly, some people have learned that it pays to have have external representation in the halls of Congress. But just because the balance is skewed right now, it does not mean that this is a natural state of affairs or the way it always has to be. What if the makeup was different? What if the majority of the groups represented the interests of coalitions of average Americans? Labor fulfilled this role once. And while it might be nice to have a revived labor movement in the US, it doesn't mean that labor is the only possible kind of representative group.

In Unequal Democracy, Larry Bartels points out that the farmers insurance groups of the late 19th century were an important lobbying group on behalf of farmers. The insurers wanted the farmers to do well, since it kept them from having to pay out insurance, which ended up benefiting both sides. Why can't other consumer lobbying firms, representing the interests of people instead of legal entities, be set up? Why can't MoveOn collect membership dues, contingent upon specific lobbying results?

Yes, the road is hard. And yes, the scales are titled against the middle class. But the current state of affairs is relatively young, and similar challenges have been overcome in the past. When the time comes for change, there's little doubt that professional interest groups will pay a key role in this change. They played a major role in every major piece of progressive legislation that was passed in the last four years. And if a more egalitarian society is to be sustained, they'll be playing a much larger role in the future.

Turning to its central theme of unequal voice in America today, The Unheavenly Chorus sets out a detailed account of differences in individual political participation. Voting is relatively egalitarian, at least compared with political contributions. Americans in the top fifth in socioeconomic status (a combined measure of income and education) are “roughly twice as likely to go to the polls as those in the bottom quintile” but about eight times more likely to make a political donation. The more affluent also vote with greater regularity from one election to the next: when turnout is low, it tends to drop the most among the disadvantaged. As a result, inequalities in voting participation are related to the overall level of turnout.While Starr sees the situation as particularly bad in his reviews, he mentions, cautiously, that organizations like MoveOn.org have the potential of increasing basic citizenship and reversing some of the recent political and economic gains made by the rich. Admittedly, Starr sees the effect as relatively small, given the extent of the problem.

Some research suggests that nonvoters do not differ in their views from voters, but The Unheavenly Chorus assembles broader evidence on participation showing that the politically inactive differ systematically from the active public. They are more likely to be in economic need and to favor universal health insurance and other social benefits. Studies of the responsiveness of government to different socioeconomic groups confirm that enacted policies reflect the views of the more affluent. In research cited by Schlozman and her co-authors, Martin Gilens of Princeton University analyzed nearly two thousand questions in public-opinion surveys about proposed national policies from 1981 to 2002. On issues where opinion varied by income, he found that the policies finally adopted were strongly related to the preferences of upper-income people, and not at all to what the poor or even middle-income Americans wanted.

The data on organized interests tell a similar story about unequal power, though with many complicating details. The authors of The Unheavenly Chorus draw on a variety of sources, but mainly they rely on an analysis that they conducted of twelve thousand organizations listed in the Washington Representatives directory. Contrary to a widespread misunderstanding, only a small proportion of groups represented in Washington (12 percent) are associations made up of individuals. The majority are corporations, governmental bodies, and associations of institutions. By sheer numbers, “representation of business is dominant.” In contrast, most workers who are neither professionals nor managers have no group in Washington representing their occupational interests, unless they are unionized—and only 7 percent of private-sector workers are now unionized. In no form of organized advocacy do organizations representing the poor register “more than a trace.” The socioeconomic tilt of the pressure-group system is hardly a mystery, especially when it comes to costly services such as lobbying. As Schlozman and her co-authors write, “Because pressure politics relies so heavily on the services of paid professionals, it is a domain that facilitates the conversion of market resources into political advocacy.”

But surely, you might think, many organizations help to rectify that situation by tapping into the less active portions of the public. Alas, The Unheavenly Chorus finds that the efforts of political groups to recruit new members and donors reinforce the socioeconomic bias in political voice. Groups searching for support act as “rational prospectors”—they hunt where the ducks are—seeking out the more affluent and educated because those are the most likely to respond. Solicited political activity turns out to be even more unequally distributed than actions that individuals say they take spontaneously on their own.

He's not alone. The central thesis of Hacker and Pierson's Winner-Take-All Politics is that government is an area for organized combat between competing interest groups. Any basic theory of public choice would show that once one specific group becomes disproportionately represented, it only follows that government has the incentives to award them disproportionately. And this is exactly what happened in the last thirty years in America. The only thing guaranteeing the current political framework is the relative strength of competing organized groups.

But what about voters? Starr doesn't pain a pretty picture about the effectiveness of the American populous, and neither do Hacker and Pierson. There is a twofold problem with American representative democracy. The first is that the most demanding aspect of civic engagement, voting, isn't actually the main show. The real competition is over the creation of policy, which is a long, slow process that very few "regular citizens" ever get involved in. It's probably why we make such a big deal about people like Lilly Ledbetter; they just don't come around all that often.

The other, probably more insidious, problem is the persistent lack of awareness and motivation among voters. Few analysts of American politics can find even a single period of American history where the majority of potential voters were well informed and active. This deep pessimism led economists like James Buchanan to conclude, all the way back in the 1960s, to conclude that governments are largely a source of market failure instead of solutions. Many economists would point out that the incentives for people to vote are very small, and it's a surprise that people vote as much as they do.

Because the institutional pressures are so intense, we shouldn't be surprised that voters fail up to the basic standards of American democracy. Nonetheless, the plain ignorance of American voters is very disappointing. As Hacker and Pierson write,

Optimists about American democracy too often presume that all this is relatively straightforward. The truth is much more unsettling—so unsettling that even in serious political discourse it is usually considered bad manners to point it out. The truth is that most citizens pay very little attention to politics, and it shows. To call their knowledge of even the most elementary facts about the political system shaky would be generous. To take just a few examples, less than a third of Americans know that a member of the House serves for two years or that a senator serves for six. In 2000, six years after Newt Gingrich became House Speaker, only 55 percent knew the Republicans were the majority party in the House—a success rate only a little superior to a random guess. Just two years after he presided over Bill Clinton’s impeachment trial in the Senate, only 11 percent of those surveyed could identify William Rehnquist as chief justice of the United States.Even though increased citizenship would be nice, there is little reason to believe that any of this would change. It's never happened before, and there's almost no reason to believe that something is going to change it soon. Maybe organizations like MoveOn can have an effect, but it will be a long time before that happens.

Crucial and basic matters of political process are equally opaque to most voters. In early 2010, as Republicans brought Washington to a halt as effectively as the unexpected winter snowstorms, most Americans had no idea that not a single Republican senator had voted for health-care reform (two-thirds either put the number at between five and twenty or said they didn’t know), and less than a third could correctly identify the number of votes needed to overcome a filibuster (sixty). Well over half of Americans either said fifty-one votes were sufficient, or confessed they had no idea.

About policy, most voters know even less, and are prone to staggering mistakes. Roughly half of Americans think that foreign aid is one of the two top expenditures in the federal budget (in reality, it consumes about 1 percent of the budget). In 1980, in the midst of the Cold War, 38 percent of Americans surveyed believed that the Soviet Union was a member of NATO—the anti-Soviet defense alliance. Two years after the huge 2001 tax cuts, half of Americans were unable to recall that there had been tax cuts at all.11 Most of the famous “swing voters,” whom journalists tend to idealize as standing above the fray, carefully sorting among the strengths and weaknesses of each party’s offerings, are actually the least engaged, least well-informed citizens, reaching a final decision (if at all) on the flimsiest grounds.

While this is a pretty depressing assessment of American democracy, it is not very new. In fact, this was a problem faced by the Founding Fathers as well. Although Thomas Jefferson's statements about "a natural aristocracy" might sound a little odd to modern readers, the underlying concept is exactly the same as the problem facing American democracy today. As Jefferson writes in a 1813 letter to John Adams,

For I agree with you that there is a natural aristocracy among men. The grounds of this are virtue and talents. Formerly bodily powers gave place among the aristoi. But since the invention of gunpowder has armed the weak as well as the strong with missile death, bodily strength, like beauty, good humor, politeness and other accomplishments, has become but an auxiliary ground of distinction. There is also an artificial aristocracy founded on wealth and birth, without either virtue or talents; for with these it would belong to the first class. The natural aristocracy I consider as the most precious gift of nature for the instruction, the trusts, and government of society. And indeed it would have been inconsistent in creation to have formed man for the social state, and not to have provided virtue and wisdom enough to manage the concerns of the society. May we not even say that that form of government is the best which provides the most effectually for a pure selection of these natural aristoi into the offices of government?Jefferson's argument would ring true to any economist. In order to overcome broadly weak incentives for voter activism, hire a few specialists. Let the division of labor sort the problem out naturally. Oddly enough, this brings organizations like MoveOn back into the spotlight. Maybe efforts at increasing public activism are ineffective, but the potential for representative work, lobbying on behalf of the middle class, is there.

To understand this potential, you need only to look at the number of representative groups in Washington that only act on behalf of organizations, something like 88 percent of them. Clearly, some people have learned that it pays to have have external representation in the halls of Congress. But just because the balance is skewed right now, it does not mean that this is a natural state of affairs or the way it always has to be. What if the makeup was different? What if the majority of the groups represented the interests of coalitions of average Americans? Labor fulfilled this role once. And while it might be nice to have a revived labor movement in the US, it doesn't mean that labor is the only possible kind of representative group.

In Unequal Democracy, Larry Bartels points out that the farmers insurance groups of the late 19th century were an important lobbying group on behalf of farmers. The insurers wanted the farmers to do well, since it kept them from having to pay out insurance, which ended up benefiting both sides. Why can't other consumer lobbying firms, representing the interests of people instead of legal entities, be set up? Why can't MoveOn collect membership dues, contingent upon specific lobbying results?

Yes, the road is hard. And yes, the scales are titled against the middle class. But the current state of affairs is relatively young, and similar challenges have been overcome in the past. When the time comes for change, there's little doubt that professional interest groups will pay a key role in this change. They played a major role in every major piece of progressive legislation that was passed in the last four years. And if a more egalitarian society is to be sustained, they'll be playing a much larger role in the future.

Friday, September 14, 2012

The Fed Moves in, Queue the Inevitable Inflation Politics

The Fed's unprecedented monetary policy is the top economic news of the week. I'll let the New York Times do the busy work.

The Federal Reserve opened a new chapter Thursday in its efforts to stimulate the economy, saying that it intends to buy large quantities of mortgage bonds, and potentially other assets, until the job market improves substantially.Tyler Cowen was one of the first to point out that this is Scott Sumner's revolution. We all are just privileged to live in it. As he writes,

This is the first time that the Fed has tied the duration of an aid program to its economic objectives. And, in announcing the change, the central bank made clear that its primary reason was not a deterioration in its economic outlook, but a determination to respond more forcefully — in effect, an acknowledgment that its incremental approach until now had been flawed.

The Fed’s policy move today might not have happened — probably would not have happened — if not for the heroic blogging efforts of Scott Sumner. Numerous other bloggers, including the market monetarists and some Keynesians and neo Keynesians have been important too, plus Michael Woodford and some others, but Scott is really the guy who got the ball rolling and persuaded us all that there is something here and wouldn’t let us forget about it.Although this blog cheers the new direction taken by the Fed, we're not here to discuss monetary policy in a lot of detail. I'm just not that good at it. Dr. Sumner's blog is a much better place for that. On the other hand, the Fed's actions have brought back the politics of inflation, sometime that's very close to my heart. The bullhorns were loud and clear over at CNBC.

Central bankers are “counterfeit money printers” and Federal Reserve Chairman Ben Bernanke should resign for messing up the U.S. economy so badly, Marc Faber, author of the Gloom, Doom and Boom, told CNBC on Friday.So what's going on? As usual, the first place to look in these sorts of debates is motivated reasoning. Marc Faber, of course, is a hedge fund manager. And he, like many other wealthy people, has very good reason to fear inflation. It will quickly and sharply eat into his assets. Once you see this, all of his other proclamations of doom and gloom can basically be ignored. Faber stands to lose a lot of money if monetary policy gets especially loose. End of story.

He said Bernanke was one of the main proponents of an ultra-expansionist economic monetary policy that was to blame for the latest financial crisis.

“If I had messed up as badly as Bernanke I would for sure resign. The mandate of the Fed to boost asset prices and thereby create wealth is ludicrous — it doesn’t work that way. It’s a temporary boost followed by a crash,” Faber said.

And while many economists lament the silly public debate over this issue, there is almost no controversy among economists about the effects of moderate inflation on employment. expansionary monetary policy benefits poor people at the expense of rich people, especially those who derive their income from wealth, i.e. people like Marc Faber. As Coibion, Gorodnichenko, Kueng and Silvia explain in an IMF working paper,

Contractionary monetary policy shocks appear to have significant long-run effects on inequality, leading to higher levels of income, labor earnings, consumption and total expenditures inequality across households, in direct contrast to the directionality advocated by Ron Paul and Austrian economists. Furthermore, while monetary policy shocks cannot account for the trend increase in income inequality since the early 1980s, they appear to have nonetheless played a significant role in cyclical fluctuations in inequality and some of the longer-run movements around the trends. This is particularly true for consumption inequality, which is likely the most relevant metric from a policy point of view, and expenditure inequality after changes in the target inflation rate.

In other words, inflation is a tax on wealth-holders used to encourage more spending. This relationship and its mechanism have been known for quite some time, essentially since the creation of the Philips curve. In that sense, Ron Paul is right; he just conveniently forgets to mention who benefits and who loses. Moderate inflation, similar to the kind that the Fed is currently implicitly pursuing, will create demand and jobs, the things that America's workers actually need. The only real question among economists is how much you can reasonably sop the rich to do something like this. There has to be limits, which is why you don't want inflationary pressure when unemployment is already around ~5 percent.

This is discussed a lot in Larry Bartels' Unequal Democracy (and in this related in the post on this blog). Republican presidents have traditionally presided over monetary regimes that are contractionary, while Democrats have pursued something slightly more expansionary. Obviously, the relationship isn't completely perfect, since it's a small data state dominated by Reagan and Carter. Nonetheless, the relationship is there, and it becomes most apparent once we look at GDP growth by p

|

| Chart taken from the Lisco Report. The original can be found here. |

There's really no doubt about it. For anyone that considers 8 percent unemployment an big deal, today's action by the Fed is great news.

Sunday, September 9, 2012

The Obama Economy, pt. 2: Job Creation

Continuing the theme of "were you better off four years ago?", three points tend to come up in the GOP's economic attack on Obama: job creation, debt and gas prices. Much of their argument is inaccurate and comes from a overwhelming desire to discredit this presidency. It's a strong reminder that we should always be aware of motivated reasoning, especially when it comes to political speech. This blog is no exception.

It might help to put some of their claims into context. Consider the following.

Total job creation under Obama has been pretty weak, there's really no debating that. But most people miss the fact that this weakness comes from significant declines in public (i.e. government) employment. Obama has overseen the largest decline in public employment in modern history. Personally, I think this is a terrible thing. But then again, I'm not the kind of person that blames government for all of America's problems.

Private employment growth has been stronger during Obama's first term than during either of the four-year terms of George W. Bush. Although, to be fair, those were some of the worst years for private job growth in modern history. So Obama's first term comes in fourth-to-last place. Better than both Bush years and better than Eisenhower's second term.

So if you are going to call job creation under Obama a catastrophe, you'd have to say the same thing about the Bush years too. And considering that Romney's economic policy and team are incredibly similar to that of George W. Bush, there's almost no reason to believe that it'd be better than what Obama has accomplished.

There's also a more meta argument here. If you were going to pick a generic Democrat or Republican to lead the economy, who would be more likely to create more jobs? The data for the post-war period side overwhelmingly with Democrats. Including Obama's weak tenure, Democrats have created 42m jobs since Kennedy entered office, while Republicans have created 29m, despite the fact that Republicans held the office for 28 years to Democtrats' 23. Even on a broader scale, going back to Truman as Politfact does, Democrats substantially outperform Republicans.

Now, if you're relatively wealthy, like most of the Republican base, this record doesn't matter much to you. Job creation is a an issue that particularly affects lower income people, and you're probably more concerned with things like inflation, interest rates and capital growth. This is fine, but these aren't really places to criticize Obama. And neither is job creation.

It might help to put some of their claims into context. Consider the following.

Total job creation under Obama has been pretty weak, there's really no debating that. But most people miss the fact that this weakness comes from significant declines in public (i.e. government) employment. Obama has overseen the largest decline in public employment in modern history. Personally, I think this is a terrible thing. But then again, I'm not the kind of person that blames government for all of America's problems.

Private employment growth has been stronger during Obama's first term than during either of the four-year terms of George W. Bush. Although, to be fair, those were some of the worst years for private job growth in modern history. So Obama's first term comes in fourth-to-last place. Better than both Bush years and better than Eisenhower's second term.

So if you are going to call job creation under Obama a catastrophe, you'd have to say the same thing about the Bush years too. And considering that Romney's economic policy and team are incredibly similar to that of George W. Bush, there's almost no reason to believe that it'd be better than what Obama has accomplished.

There's also a more meta argument here. If you were going to pick a generic Democrat or Republican to lead the economy, who would be more likely to create more jobs? The data for the post-war period side overwhelmingly with Democrats. Including Obama's weak tenure, Democrats have created 42m jobs since Kennedy entered office, while Republicans have created 29m, despite the fact that Republicans held the office for 28 years to Democtrats' 23. Even on a broader scale, going back to Truman as Politfact does, Democrats substantially outperform Republicans.

|

| Image courtesy of Bloomberg Government. The original is available here. |

Saturday, September 8, 2012

Science vs Folk Wisdom

The Economist has an excellent passage on scientific method buried within a broader piece about the general state of the world economy.

"The problem is that anecdotal evidence often seems much more compelling than dry statistics. Man seems to have a tendency to impart information in the form of a story. This is often known as the availability heuristic and leads to arguments like "Smoking's not dangerous. My mother smoked 40 cigarettes a day and lived to 90." (Indeed, Mr Akin used the formulation "from what I understand from doctors", an anecdotal approach.)

[...]

Official data are often flawed and need to be revised; we should always be on the lookout for rogue items that stand out from the general trend. But economic statistics are (generally) honest attempts to make sense of vast, complex systems. They offer a more robust view of the world than your brother-in-law or the story your neighbour heard at work."

Friday, September 7, 2012

The Obama Economy, pt. 1: Unemployment

The unemployment rate is one of the most persistent criticism's of Obama's economic management. The usual refrain goes something like this, "when Obama started, the unemployment rate was at 8.3 percent. Right now it's still there. What good has he done?" Technically speaking, the argument is correct; I guess people deserve some credit for not just making up statistics. But nonetheless, it's still a game of shifting the goal post. Is there anything realistically feasible that a president can do in his first months to solve an economic crisis without passing legislation? I don't know, but I'd love to hear others' opinions.

Job losses continued throughout 2009, but the rate of losses bottomed out as soon as the stimulus was passed (February). Private sector job growth has remained positive since February 2010, but total job growth was negative in a couple months because government has been firing people for a couple years now. In fact, government employment has reduced more under Obama than under any president in the last three decades. Yes, that includes Ronald Reagan.

Unemployment peaked at 10 percent in October 2009, and it has declined by almost two percentage points since then. (Be sure to adjust the scale up to the last four years) There are certainly problems with how that is measured, since it's based on a survey of individuals actually seeking work, but it's hard to call that a complete failure.

I think a relevant comparison is Ronald Reagan, who was able to reduce unemployment from 10.8 percent to 7.4 percent in a similar period. (expand the time scale on the Google Public Data link to see this. The relevant period is 33 mos.) But before we starting singing hallelujah to the Gipper (again), let's keep these things in mind:

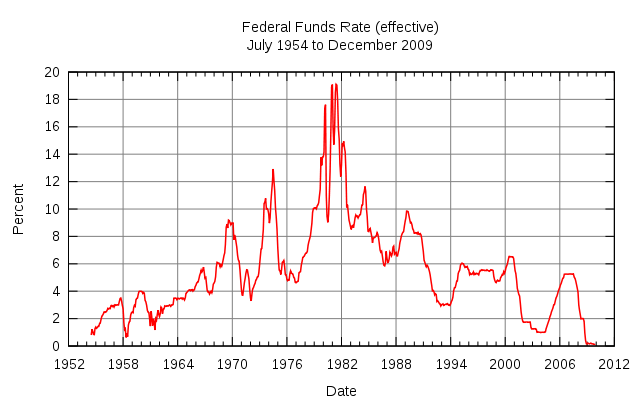

These are very different conditions than what Obama inherited. Debt as a percentage of GDP was already high, so not much room for additional spending. The federal funds rate was already essentially zero, so you couldn't get additional economic activity through a rate cut. To top it all off, Obama's recession was the result of a financial crisis, which Harvard economists Reinhart and Rogoff point out are especially difficult to recover from. This is due to the huge amount of private debt left in the economy after the crisis.

So it would be hard to call this a "failed" presidency. It was the biggest economic crisis since the Great Depression. In some ways it was handled quite well, like with stopping the banking collapse, in other ways it wasn't, like solving the debt problem many homeowners still face. This is why the Economist, which is not a liberal publication, gave Obama relatively strong marks for his economic stewardship. This certainly isn't the way the Right wants to paint him, but that's mostly because it completely undermines their message in the upcoming election.

Job losses continued throughout 2009, but the rate of losses bottomed out as soon as the stimulus was passed (February). Private sector job growth has remained positive since February 2010, but total job growth was negative in a couple months because government has been firing people for a couple years now. In fact, government employment has reduced more under Obama than under any president in the last three decades. Yes, that includes Ronald Reagan.

Unemployment peaked at 10 percent in October 2009, and it has declined by almost two percentage points since then. (Be sure to adjust the scale up to the last four years) There are certainly problems with how that is measured, since it's based on a survey of individuals actually seeking work, but it's hard to call that a complete failure.

I think a relevant comparison is Ronald Reagan, who was able to reduce unemployment from 10.8 percent to 7.4 percent in a similar period. (expand the time scale on the Google Public Data link to see this. The relevant period is 33 mos.) But before we starting singing hallelujah to the Gipper (again), let's keep these things in mind:

- Reagan's recession was started by the Federal reserve, which raised interest rates by 11.5 points (10% June 1981 to 21.5% June 1982).

- Once Volcker had inflation contained, he was able to reduce interest rates basically back to where they originally were, increasing economic growth.

- Reagan was able to spend quite a bit more than Obama in order to further encourage economic growth.

These are very different conditions than what Obama inherited. Debt as a percentage of GDP was already high, so not much room for additional spending. The federal funds rate was already essentially zero, so you couldn't get additional economic activity through a rate cut. To top it all off, Obama's recession was the result of a financial crisis, which Harvard economists Reinhart and Rogoff point out are especially difficult to recover from. This is due to the huge amount of private debt left in the economy after the crisis.

So it would be hard to call this a "failed" presidency. It was the biggest economic crisis since the Great Depression. In some ways it was handled quite well, like with stopping the banking collapse, in other ways it wasn't, like solving the debt problem many homeowners still face. This is why the Economist, which is not a liberal publication, gave Obama relatively strong marks for his economic stewardship. This certainly isn't the way the Right wants to paint him, but that's mostly because it completely undermines their message in the upcoming election.

Monday, September 3, 2012

Grappling with American Oligarchy

Paul Starr over at The New Republic has an excellent review of The Unheavenly Chorus, Oligarchy and The MoveOn Effect. Here's what he has to say of the first of those three books:

Turning to its central theme of unequal voice in America today, The Unheavenly Chorus sets out a detailed account of differences in individual political participation. Voting is relatively egalitarian, at least compared with political contributions. Americans in the top fifth in socioeconomic status (a combined measure of income and education) are “roughly twice as likely to go to the polls as those in the bottom quintile” but about eight times more likely to make a political donation. The more affluent also vote with greater regularity from one election to the next: when turnout is low, it tends to drop the most among the disadvantaged. As a result, inequalities in voting participation are related to the overall level of turnout.The MoveOn Effect seems to suggest that a solution to this problem is a new age of organization. Although reports of the Internet's transformation of politics are wildly exaggerated, it is nonetheless important to consider the Internet as one of many tools of fostering a new age of populist organization. Without a doubt, increased representation holds the potential to stem the growth of the new American oligarchy, and perhaps even reverse it's tide.

Some research suggests that nonvoters do not differ in their views from voters, but The Unheavenly Chorus assembles broader evidence on participation showing that the politically inactive differ systematically from the active public. They are more likely to be in economic need and to favor universal health insurance and other social benefits. Studies of the responsiveness of government to different socioeconomic groups confirm that enacted policies reflect the views of the more affluent. In research cited by Schlozman and her co-authors, Martin Gilens of Princeton University analyzed nearly two thousand questions in public-opinion surveys about proposed national policies from 1981 to 2002. On issues where opinion varied by income, he found that the policies finally adopted were strongly related to the preferences of upper-income people, and not at all to what the poor or even middle-income Americans wanted.

The data on organized interests tell a similar story about unequal power, though with many complicating details. The authors of The Unheavenly Chorus draw on a variety of sources, but mainly they rely on an analysis that they conducted of twelve thousand organizations listed in the Washington Representatives directory. Contrary to a widespread misunderstanding, only a small proportion of groups represented in Washington (12 percent) are associations made up of individuals. The majority are corporations, governmental bodies, and associations of institutions. By sheer numbers, “representation of business is dominant.” In contrast, most workers who are neither professionals nor managers have no group in Washington representing their occupational interests, unless they are unionized—and only 7 percent of private-sector workers are now unionized. In no form of organized advocacy do organizations representing the poor register “more than a trace.” The socioeconomic tilt of the pressure-group system is hardly a mystery, especially when it comes to costly services such as lobbying. As Schlozman and her co-authors write, “Because pressure politics relies so heavily on the services of paid professionals, it is a domain that facilitates the conversion of market resources into political advocacy.”

But surely, you might think, many organizations help to rectify that situation by tapping into the less active portions of the public. Alas, The Unheavenly Chorus finds that the efforts of political groups to recruit new members and donors reinforce the socioeconomic bias in political voice. Groups searching for support act as “rational prospectors”—they hunt where the ducks are—seeking out the more affluent and educated because those are the most likely to respond. Solicited political activity turns out to be even more unequally distributed than actions that individuals say they take spontaneously on their own.

The central thesis of Winner-Take-All Politics is that government is an area for organized combat between competing interest groups. Any basic theory of public choice would show that once one specific group becomes disproportionately represented, it only follows that government has the incentives to award them disproportionately. And this is exactly what happened in the last thirty. The only thing guaranteeing the current political framework is the relative strength of competing organized groups.

Look of the number of representative groups in Washington that only act on behalf of organizations (something like 88 percent). When the odds are skewed that heavily, it's no wonder that Middle Class Americans regularly find themselves on the losing end of Washington policy. What if the makeup was different? What if the majority of the groups represented the interests of coalitions of average Americans? Labor fulfilled this role once. And while it might be nice to have a revived labor movement in the US, it doesn't mean that labor is the only possible kind of representative group.

In Unequal Democracy, Bartels points out that the farmers insurance groups of the late 19th century were an important lobbying group on behalf of farmers. The insurers wanted the farmers to do well, since it kept them from having to pay out insurance, which ended up benefiting both sides. Why can't other consumer lobbying firms, representing the interests of people instead of legal entities, be set up? The only thing holding anyone back is willpower.

Sunday, September 2, 2012

Pomp and Circumstantial Evidence

John H. Richardson over at Esquire reports on the comedy, pageantry and tragedy of Ron Paul's Subcommittee on Domestic Monetary Policy and Technology.

So there you have the national debate a nutshell: The Republicans offer folk wisdom, fringe economics, and a continued obsession, two decades after the collapse of communism, with central planning; the Democrats come with statistics and studies but have become too demoralized and feckless to do much more than invoke Milton Friedman. Then a handful of overworked reporters ask a tiny handful of timid questions and rush off to file superficial stories that everyone ignores, leaving Paul to a line of fans led by a white Rasta with a small pamphlet in his hand: 'Will you sign my Constitution, since you're the only one that follows it?'The government we deserve...

Subscribe to:

Posts (Atom)